OzenFX.com Review: A Comprehensive Examination of the Platform

Table of Contents

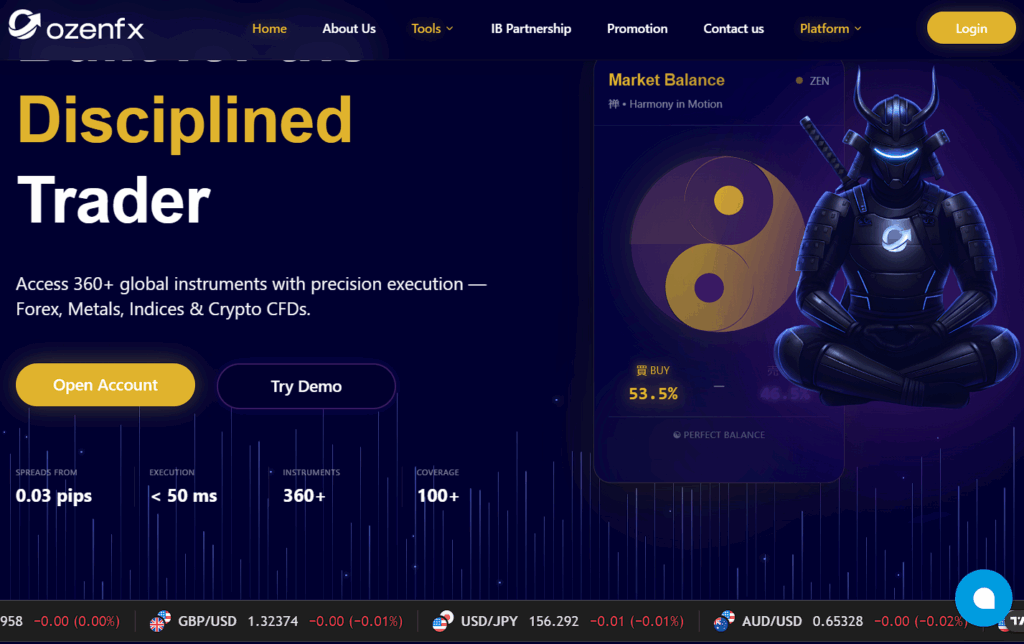

OzenFX.com presents itself as a sophisticated online trading platform promising access to global financial markets, advanced trading tools, and structured investment plans. Its website highlights forex trading, automated systems, guided strategies, and account tiers designed to attract both new and experienced traders. At first glance, OzenFX appears polished and ambitious, using strong marketing language to position itself as a modern gateway to online investing.

However, a deeper review raises several operational concerns and structural inconsistencies that demand close examination. This analysis dissects OzenFX’s claims, business model, user experience patterns, transparency issues, and potential red flags. The goal is to offer readers a clear, comprehensive understanding of how the platform presents itself, how it appears to operate, and what precautions are reasonable when interacting with services of this nature.

1. What OzenFX Says It Provides

OzenFX markets itself as a multi-asset trading platform offering features such as:

- Access to forex, commodities, indices, and crypto products

- Automated trading tools and signals

- Multiple account tiers with increasing benefits

- “Dedicated managers” for higher-tier users

- Fast trading execution and simplified deposits

- User-friendly dashboards tailored for newcomers

The branding emphasizes professional presentation, advanced technology, and the promise of financial growth through structured investment plans. These claims mirror many modern trading websites, but the real question becomes whether the underlying structure matches the marketing language.

2. First Impressions: Professional Design With Pressured Enrollment

The Visual layout of OzenFX’s website feels refined. The homepage uses confident messaging, clean typography, and a conversion-focused layout. Several noticeable elements stand out:

Strong Calls to Action

Buttons like “Create Account,” “Start Trading,” and “Upgrade Now” are strategically placed to direct new users toward fast registration.

Emphasis on Success Imagery

Charts in upward motion, testimonials without detailed attribution, and promotional banners all work together to convey trust and momentum.

Predominantly Marketing-Driven Language

The emphasis appears to be on quick enrollment rather than detailed explanations about risk, regulation, governance, or the team running the platform.

Professional visuals are common across many high-risk investment websites. A polished design is not proof of operational strength, so the key questions lie beneath the surface.

3. Structural Transparency: What’s Missing or Unclear

When evaluating any trading platform, transparency is the cornerstone. Several points on OzenFX’s website warrant closer scrutiny.

Absence of Verifiable Corporate Identity

A credible platform typically provides clear information about:

- Corporate ownership

- Registered business name

- Jurisdiction

- Corporate address

If this information is limited, vague, or difficult to verify independently, it introduces uncertainty around who controls the platform.

Regulation Claims Without Apparent Traceability

Regulated brokers display:

- Active license numbers

- Exact regulatory jurisdictions

- Matching company names across registries

If such specifics are missing or inconsistent, it suggests that the platform may operate without regulatory oversight.

No Publicly Identifiable Leadership Team

Platforms with professional management usually showcase their leadership, including biographies and verified experience. A lack of identifiable executives makes it difficult to evaluate accountability.

Unclear Custody of Client Funds

Users should always be told:

- Where funds are held

- Which banks manage deposits

- Whether accounts are segregated

The absence of this information makes it difficult to verify how client money is handled.

Transparency gaps do not automatically classify a platform as fraudulent, but they do raise relevant concerns for any trader evaluating trustworthiness.

4. Operational Red Flags Common to Higher-Risk Platforms

Through analysis of OzenFX’s publicly visible structure and comparison with broader industry patterns, several operational warning signs stand out.

Vague Licensing Language

Platforms sometimes use generalized statements like “operates in compliance with financial standards” without referencing actual regulators or legally recognized licenses. This is a meaningful red flag.

Anonymous Website Registration

Domain registrations masked behind privacy services reduce the ability to identify ownership.

Promotions and Bonus Structures

If the platform offers bonuses tied to strict trading thresholds or turnover requirements, it may effectively restrict withdrawals.

Aggressive Deposit Incentives

Offers such as deposit matches, referral rewards, and “priority trading accounts” often serve as pressure mechanisms.

Support That Shifts After Deposits

A common pattern in high-risk environments is:

- Very responsive support during sign-up

- Noticeably slower or scripted responses during disputes

Any shift in communication quality may signal operational weaknesses.

5. How OzenFX’s Account System Appears Structured

Based on its public presentation, OzenFX uses a tiered account system designed to funnel users toward higher deposit levels.

Basic Account

- Low entry requirement

- Minimal features

- Used primarily to onboard first-time customers

Intermediate Tiers

- Require larger deposits

- Promise “better tools” or “priority access”

- Often paired with an account manager

Top-Tier or VIP Accounts

- Very high deposit minimums

- “Exclusive” tools, signals, or market opportunities

- Faster processing times or special services

Tiered structures are common, but they become concerning when used to pressure users into continuous upgrading rather than transparent, structured service delivery.

6. Deposit Methods and Processing Behavior

OzenFX appears to accept multiple types of deposits:

- Bank transfer

- Card payments

- Cryptocurrency

- E-wallets

The platform highlights “quick funding” as a feature. It is typical for such websites to ensure a smooth deposit experience because it fuels onboarding momentum.

Irreversible Payment Methods

If the platform heavily encourages cryptocurrency or other irreversible payment channels, this is an important detail for users to consider, as it implies finality of transfers.

7. Trading Tools and Algorithmic Features

OzenFX promotes automated or semi-automated trading solutions. These can include:

- Bots

- Copy-trading services

- Signal alerts

- Algorithmic strategies

The key question becomes: Is any of this independently verified or audited?

If performance claims lack:

- Transparent track records

- Independent auditing

- Externally verified metrics

then users cannot reliably evaluate the quality or legitimacy of the advertised trading systems.

8. Withdrawal Experience and Document Requirements

Based on common industry patterns, platforms like OzenFX may feature:

- Straightforward deposit processes

- Withdrawal systems that require additional verification

- Newly introduced fees or processing steps during withdrawal

Users evaluating such a platform should observe:

- Whether withdrawal timelines are clearly stated

- Whether fees are transparent

- Whether additional documentation appears reasonable or excessive

Sudden new requirements that emerge only at withdrawal time are a classical friction point.

Report ozenfx and Recover Your Funds

If you have incurred financial losses to ozenfx or a similar platform, it is crucial to take immediate action. Report the incident to SPS Investigation Ltd, a reputable organization committed to assisting victims in recovering their misappropriated funds.

9. User Experience Patterns Commonly Reported with Similar Platforms

Across the online trading sector, especially with lesser-known platforms, certain recurring patterns appear frequently. These include:

Early Encouragement and Positive Reinforcement

New users may receive constant encouragement to deposit more, upgrade plans, or engage in larger trades.

Account Manager Pressure

Some users report strong pressure from “managers” urging:

- Higher deposits

- Tier upgrades

- Participation in exclusive offers

Dashboard Results That Seem Too Consistent

Unrealistically steady profit curves or unusually high success rates can indicate simulated outcomes rather than real market performance.

Withdrawal Delays and Procedural Loops

Repeated cycles of “pending,” “processing,” or added verification tasks are common friction points in high-risk environments.

Support Becomes Less Available Over Time

Users often experience friendly support initially, followed by slower responses when attempting to withdraw funds or question trade results.

These patterns do not prove misconduct but do reflect risks that readers should understand when assessing platforms with similar structures.

Ever had an encounter with ozenfx or a similar platform? Contribute your insights in the comments section or seek guidance on prudent investment strategies. Remain vigilant and prioritize personal security at all times when navigating the digital financial landscape.